In November-December 2020, we conducted an anonymous survey of recruiting company managers who were readers of the telegram channel @recruitment entrepreneurs.

46 companies took part in the survey.

These stats were gathered to get information from each company and identify trends in the market.

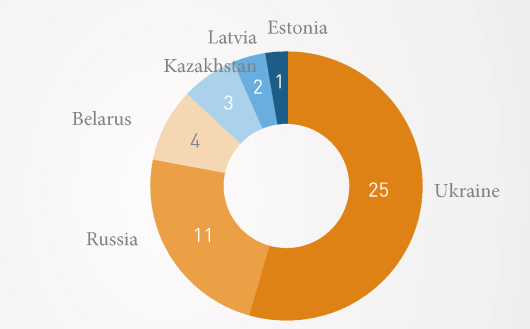

Distribution of companies by country

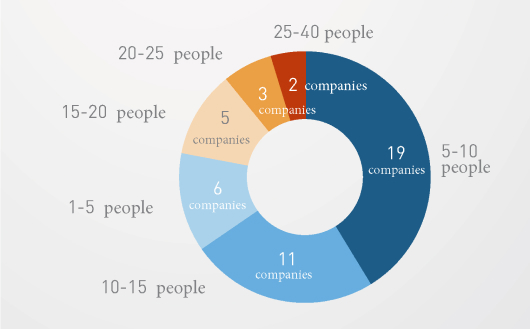

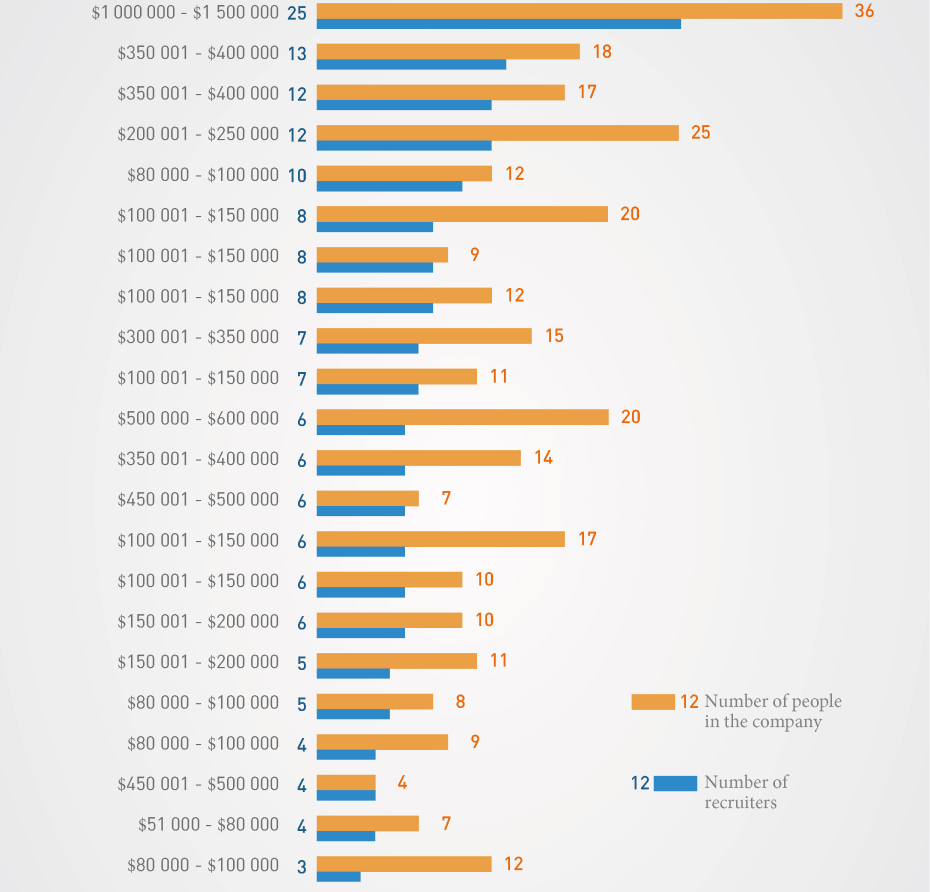

By number of employees:

Separately, I would like to note that of the 25-40 people companies, there were 2 agencies from Russia, while most of the companies were from Ukraine.

On average, companies were composed of 12-20 people; 9 companies indicated this data.

Interestingly – the number of recruiters in companies of 5 and 15 people, respectively, differed only slightly (4-7 people). This allows us to conclude that other employees in the company are sourcers and administrative personnel.

According to their responses, the exception was 2 companies from Ukraine with 17 and 12 employees, with 18 in total and 13 recruiters, respectively.

Some companies have 12 people in total, and only 3 of them are 3 recruiters, 14 people in total, and 6 are recruiters.

I was interested in the question of the number of recruiters, because they are usually the more expensive part in the company, while sourcers can cost

$300-500 (CIS).

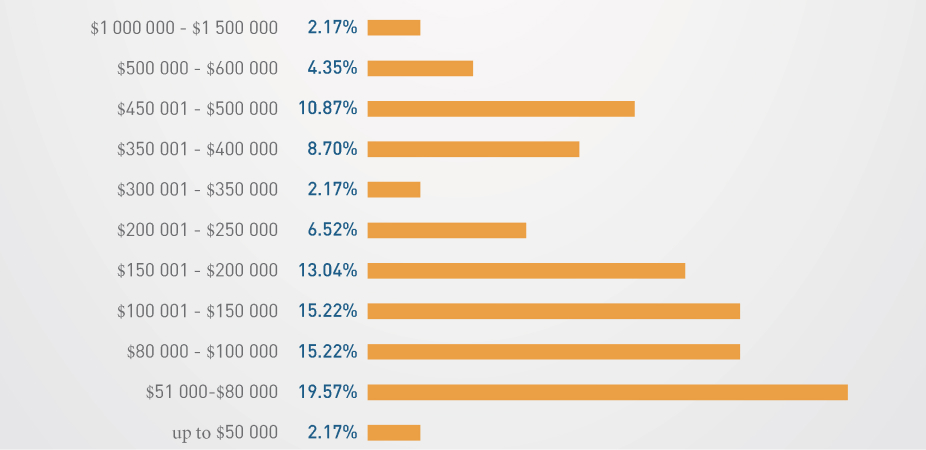

Income and turnover

on gains that the company planned to the end of the year to give the following statistics:

Company data by country and size of speed in excess of $ 250 000 per year:

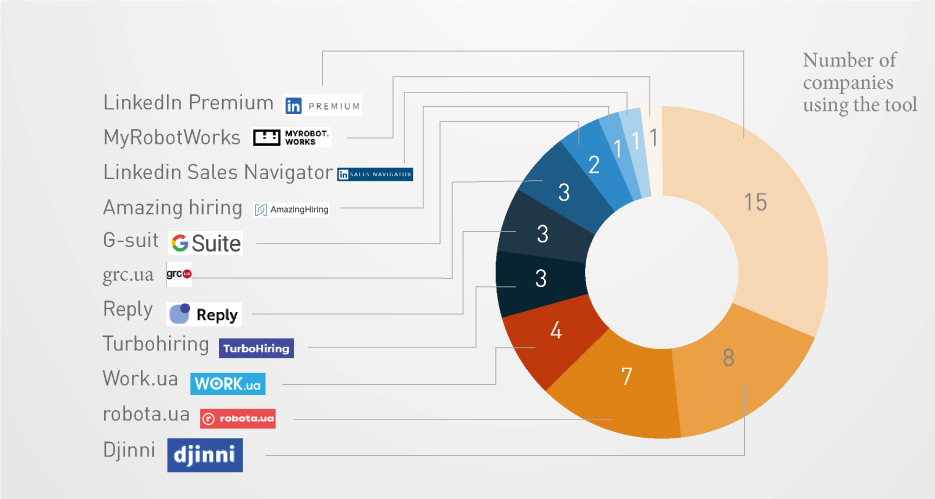

Paid instruments

On paid tools that are used are listed as follows:

Correlation of the number of people with income in some companies

We can see some unusual moments, such as how much you have to pay recruiters and some “margin” in the company of such figures:

![]()

However, studying how many systems of motivation and approaches to doing business local agencies have, we can’t exclude that here, too, there may be quite a profit-generating business.

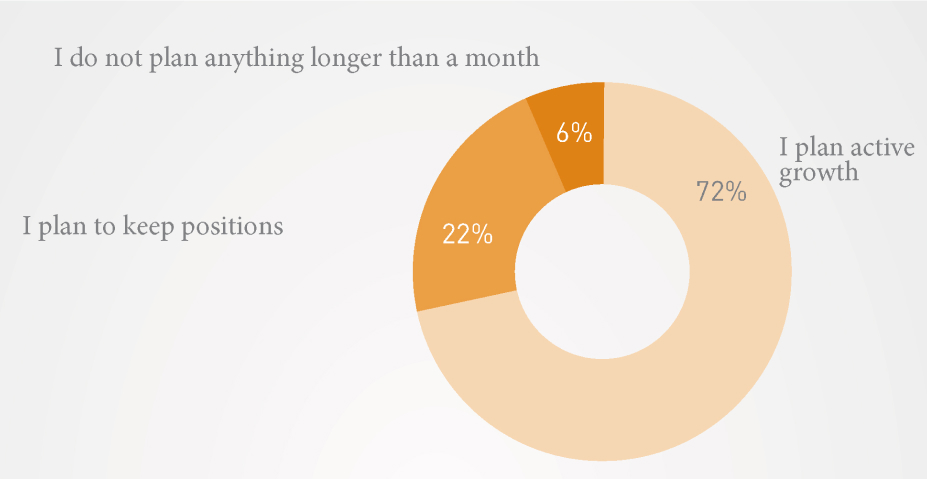

Forecasts for 2021

When we regarded the stages (development, maintaining positions, lack of strategic plans) of the company, the following data was revealed:

We see that a large part is planning to grow. The market only contributes to this both at the end of 2020 and the beginning of 2021. This allows everyone an excellent opportunity to carry out such plans!

Moreover, some of those with an income of $80-100,000 want to maintain their positions, which may indicate that companies are quite comfortable in the format they currently have or are not ready to scale.

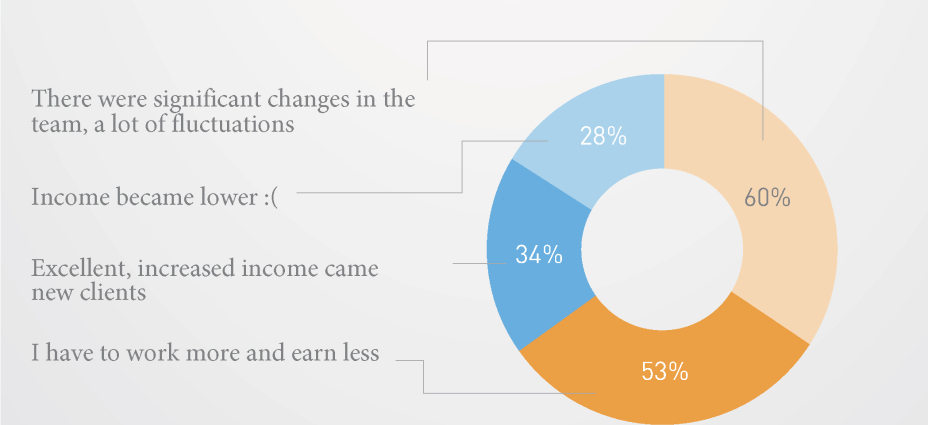

What trends happened to companies during the year?

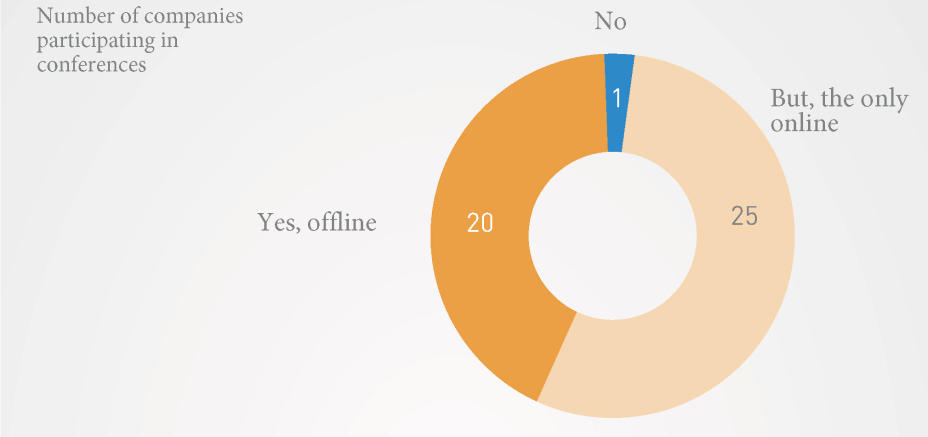

Participation in conferences

on the issue of participation in conferences following answers:

Channel estimation

Average assessment of the utility of the material in the channel = 4.7, which I think is pretty high.

Special thanks to everyone who wrote suggestions, what to improve and what they don’t like.

I would like to note that agencies with high turnover figures had “4” and, most likely, with very experienced managers, from whom, I am sure, worth it would be learning from.

In conclusion,

Thank you to everyone who took part in the survey, especially those who provided truthful information.

One manager even wrote in early January that he filled out a questionnaire with only numbers. When he counted everything, he got +50,000 dollars more because there was a “boom” in December (the updated figure is taken into account here;).

I am sure that such errors can be and, of course, more relevant and objective data could be obtained with a more significant number of participants.

I hope this review will be one of the starting agencies for analytics, and the more data on the market, the more conclusions, and areas for growth each of us will be able to find! And yes, there will be conferences on this topic 🙂 stay tuned!